- The bond, issued by Banco Internacional in Ecuador, will support ocean-friendly projects and clean water resource protection.

Quito and Luxembourg, 12 December 2022 – LAGreen, the Latin American Green Bond Fund, advised by Finance in Motion and Santander Asset Management, has partnered with the International Finance Corporation (IFC) as lead investor, and Symbiotics Investments in this landmark USD 79 million blue bond issued by Banco Internacional in Ecuador.

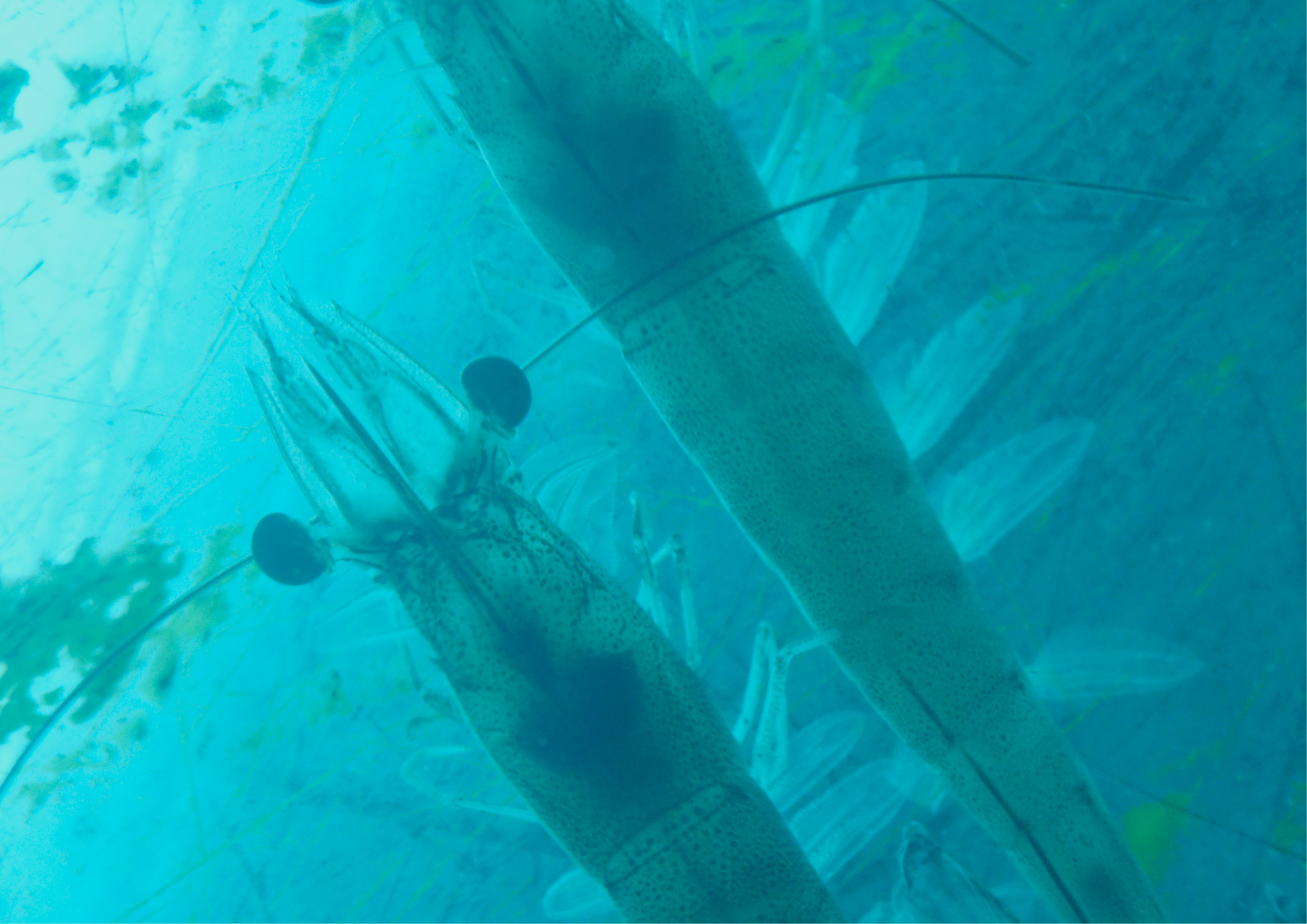

Structured in line with ICMA’s Green Bond Principles and IFC’s Blue Finance Guidelines, the bond will mainly finance investments in the value chain of the sustainable fisheries and aquaculture sectors. The use of proceeds is intended to contribute to numerous SDGs, but particularly to SDG 12 (responsible consumption and production) and SDG 14 (life below water).

Banco Internacional, founded in 1973, has operations throughout Ecuador and serves more than 500,000 clients. The bank is an ideal partner for a blue bond, due to its capacity to reach companies in the fisheries and aquaculture sectors that are adopting sustainable production practices, several of which are certified under internationally recognized sustainability standards, such as the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) certification.

Sustainable fisheries and aquaculture are highly relevant sectors in Ecuador both from an economic and environmental perspective. For example, the industry of shrimp production is an increasingly important contributor to exports and job creation. At the same time, local companies are making progress towards the adoption of sustainable production practices, with positive impacts in the areas of biodiversity conservation, sustainable use of natural resources, and climate action, a trend that will be further supported with the funding mobilized through this bond.

LAGreen’s investment was channeled through the subscription of a USD 23 million bond, issued by Micro Small and Medium Enterprises Bonds S.A., sponsored by Symbiotics Investments. The bond is listed on the Luxembourg Stock Exchange (LuxSE) and displayed on the Luxembourg Green Exchange (LGX). The proceeds of this bond were dedicated to investing in the blue bond issued by Banco Internacional in the Quito Stock Exchange.

LAGreen Chairperson Johannes Scholl said: “This blue bond is strongly aligned with our strategy of enhancing LAGreen’s impact by focusing on the sectors that are more relevant in each country from an economic, environmental and climate perspective. We are also very proud to be part of this historical issuance with Banco Internacional and IFC and believe that blue bonds will prove to be an effective tool in promoting the production practices that contribute to enhancing ocean and coastal preservation.”

“As a member of LAGreen’s advisory group, it is a pleasure to facilitate LAGreen’s blue bond investment through LuxSE and LGX. LAGreen’s ambitious goal of building the green bond market in Latin America’s emerging markets is a cause shared by LuxSE. By channeling the use of proceeds to finance sustainable water and wastewater management and aquatic biodiversity amongst other eligible projects, LAGreen is giving Latin American players an important opportunity to make a real impact not just locally but throughout the world,” commented Laetitia Hamon, Head of Sustainable Finance at LuxSE.

Elizabeth Martínez Marcano, IFC’s Manager for the Andean Region, said: “By announcing this commitment in Ecuador, IFC will be contributing to the development of local debt capital markets while fostering blue finance opportunities. We are optimistic IFC’s support will catalyze other market players to offer blue bonds and related financing instruments in the region, supporting a robust blue economy.”

Francisco Naranjo, CEO of Banco Internacional, said: “Banco Internacional will be proud to be the first private financial institution in the region to issue blue bonds. This new milestone reaffirms our commitment to sustainable finance and contributes to economic growth through responsible practices with the environment.”

“We are proud to have assisted LAGreen in channeling these funds to participate in the first blue bond issued by the private sector in Latin America. Thanks to our platform, a range of investors get simplified access to impact investment opportunities, including local bond issuances, in over 70 emerging and frontier markets, through LSE-listed notes. We intend to grow this offer going forward, which will permit to channel more funding into highly needed sustainable projects around the world,” said Daniel Schriber, Head of Investment at Symbiotics Investments.

About LAGreen

LAGreen is the first green bond fund dedicated to Latin America.

By investing in green bonds and supporting new issuers with technical assistance, LAGreen’s goal is to boost environmental and social benefits across the region and promote the transition to a green economy. In addition, the fund aims to promote high impact standards for green bonds, both in terms of the impact of supported projects, as well as green credentials, reporting, and impact assessment.

As an impact investment fund advised by Finance in Motion and Santander Asset Management,

LAGreen was established as an initiative of Germany’s KfW Development Bank, with seed capital provided by the European Union (EU) and the German Federal Ministry for Economic Cooperation and Development (BMZ).

For more information visit https://lagreen.lu and follow us on LinkedIn.

About Banco Internacional

Banco Internacional was founded in Quito in 1973, has more than 1300 employees committed to the satisfaction of its customers nationwide. Banco Internacional is the leading bank in efficiency, it stands out for its focus on small, medium and large companies, as well as people of high and medium income. The institution has 73 branches nationwide in 17 provinces, in the Sierra, Costa and Amazon regions, and more than 360 ATMs.

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2022, IFC committed a record $32.8 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org.

About Symbiotics Investments

Symbiotics is the leading market access platform for impact investing, dedicated to private markets in emerging and frontier economies. The group offers investment, asset management and capacity building services. Since 2005, Symbiotics Investments has originated over 7,100 investments representing more than USD 7.5 billion for 541 companies in 94 countries. For more information, visit symbioticsgroup.com.

Media contact LAGreen

Merle Römer

Manager Marketing & Communications

Phone: +49 (0)69 271 035-171

Email: info@lagreen.lu

Media contact Symbiotics

Samy Derradji

Corporate Communication Manager

Email: samy.derradji@symbioticsgroup.com